Portland Housing Market Forecast: What's ahead for 2022?

/After meeting with lenders, title companies, and, just this week, The Oregon Office of Economic Analysis, I have a few important takeaways that all buyers, sellers, homeowners, and investors should know about what is likely to come in 2022 in the Portland housing market. So, what should we expect?

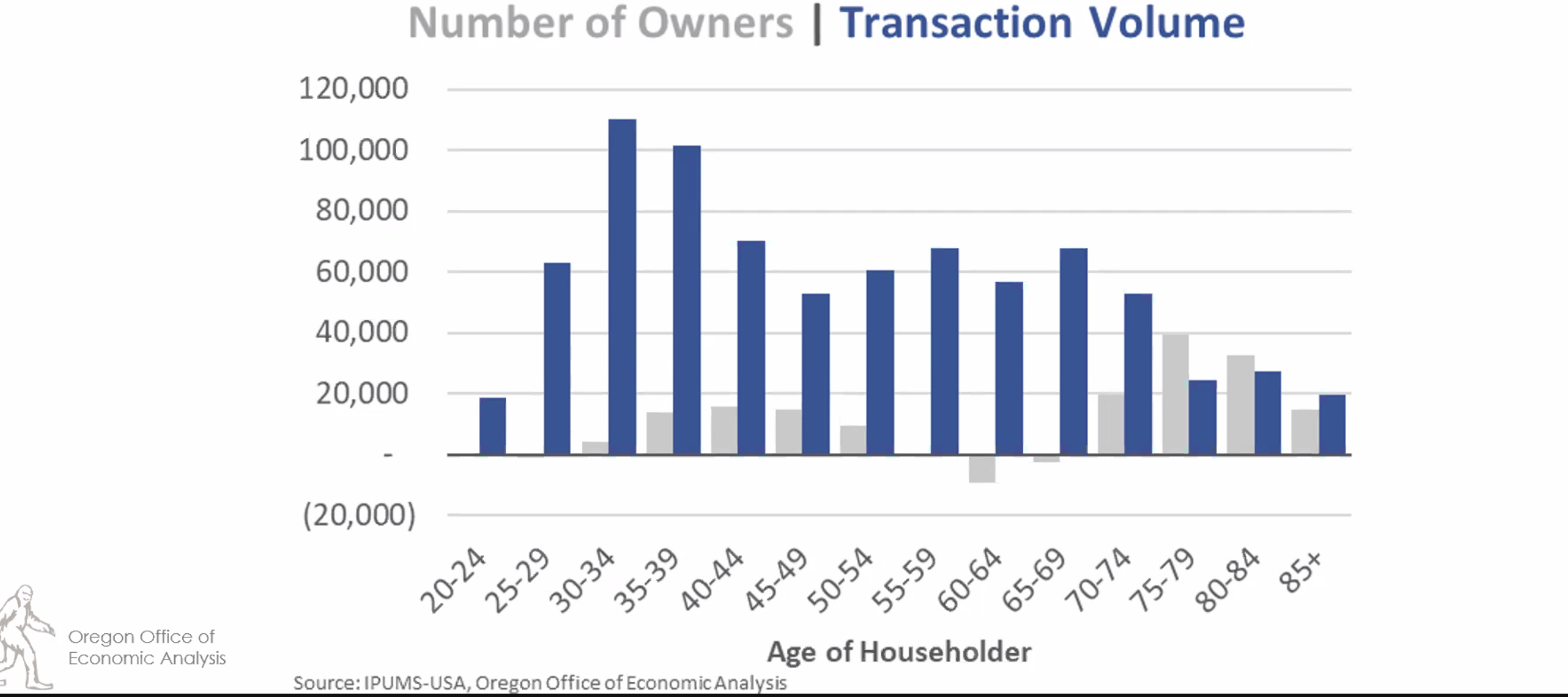

Buyer demand will continue as home loan interest rates rise

If you are looking to purchase a home in the Portland Metro area in 2022, expect that you will still be competing against a lot of other qualified buyers in order to get in contract on a home. Now, you may be thinking: “But I heard rates are going up? Won’t that slow down the market?” Yes, rates are already ticking up and are currently averaging about 3.5% this week. However, the housing shortage is what is really leading to the demand. So, while rates are not as favorable as they have been for the last few years, they are right around where they were pre-pandemic (and we thought those were great rates then!). If you can buy your next home before 2023, you may still get a loan with a rate under 4% but if inflation increases and the Federal Reserve does not return to buying mortgage backed securities—something they did during the pandemic for the first time ever—expect interest rates to continue to slowly creep up year after year for a bit of time. Historically speaking, we have all become used to these rockbottom rates but it isn’t the norm and it likely won’t continue indefinitely.

Sale prices will increase but not as fast as in 2021

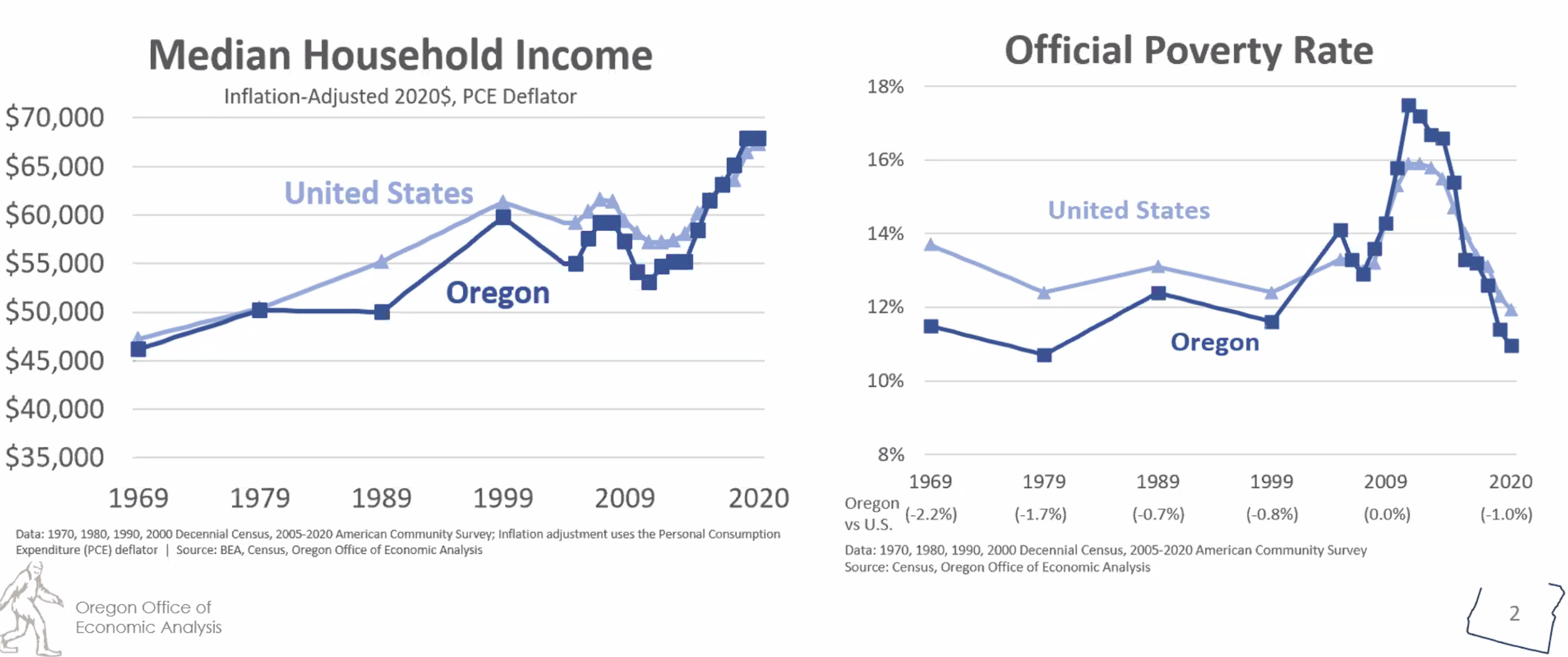

Do not interpret that to mean sales will be flat or decline. Oregon Economists are predicting an 8-11% annual increase in home prices over the next year and then 3-4% in 2023. However, with the raise in rates, buyers will have less purchasing power which may result in a slowing of price hikes. It’s also really hard—not to mention unsustainable—to see 17% growth year over year. 11% more next year is probably still more than you want to pay but it may make the market a little more tolerable for first time buyers. Sellers: your home will still see a lot of equity gains this year but be reasonable when you list. Listen to a pricing expert and do not overprice your home when you go to market.

Fewer vacation properties will be bought and sold after April

Effective April 1, the interest rates on second homes will be comparable to non-owner occupied (investment) properties, meaning they will be significantly higher. However, down payment requirements will remain the same. We saw a lot of homes being purchased and sold in secondary markets on the coast and at lakes during the height of the pandemic due to the perfect storm of work from home realities, a rise in American wealth, and low interest rates. But as we approach spring, expect that that buying appetite may begin to slow as folks contemplating a beach condo or lake side cottage think twice when considering the increased monthly payment.

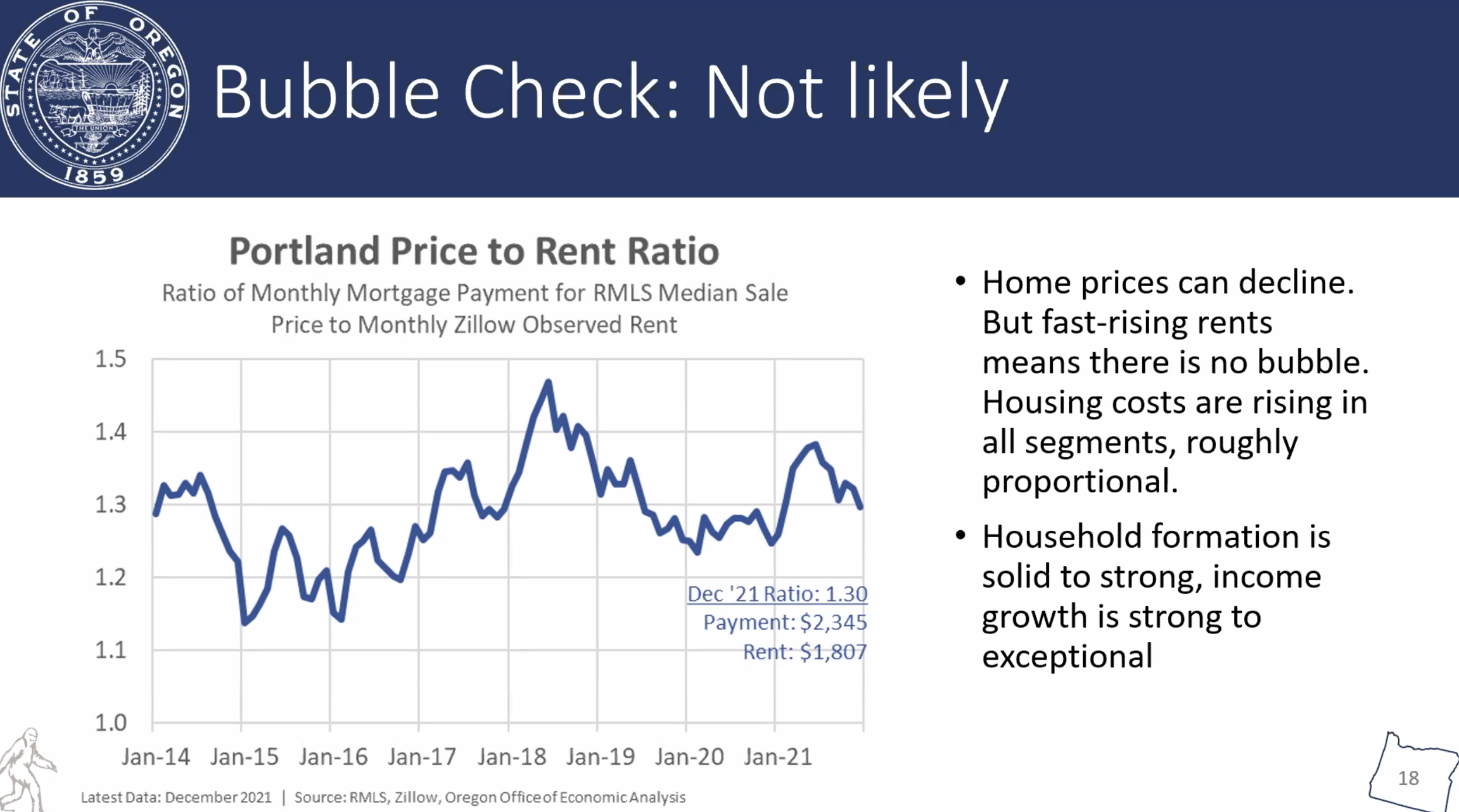

Rents will also rise and keep pace or exceed mortgages

When folks ask “are we in a bubble?” there are a lot of factors that I explain which essentially lead tot he answer “Not likely.” But one big one is that rents are outpacing or staying on par with mortgages. At the end of the day a roof over your head is just that, which means potential homebuyers who can qualify for a loan are willing to pay in a mortgage what they will pay in rental income. After all, with few exceptions, owning a home is generally more advantageous than renting.

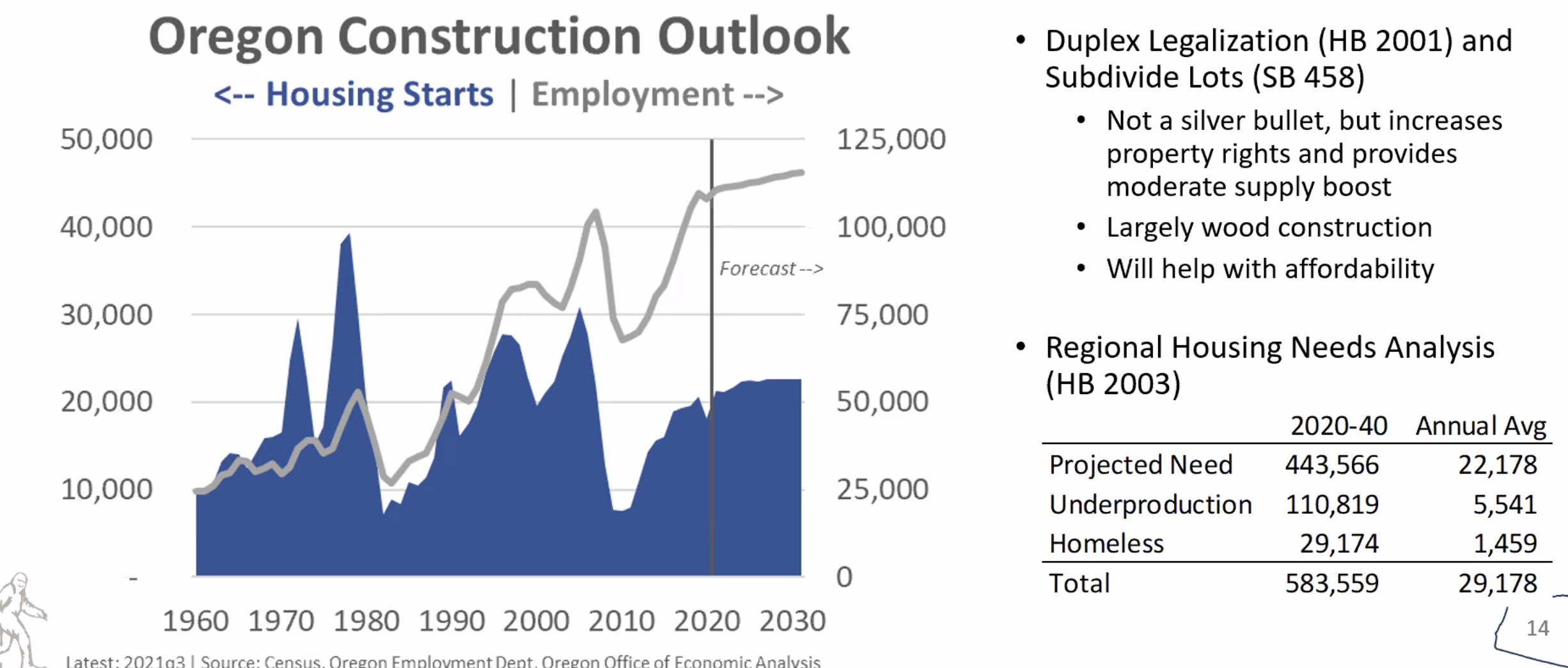

Condos and townhomes will become more of a seller’s market than in recent years

Many well qualified buyers who are tired of being outbid on a single family home, may begin to consider the townhome or condo market. After all, there is 2.5 months inventory of condos as opposed to less than half of a month in single family homes. And, sellers take note: condo inventory has shrunk in recent months as well which is making it a much better time to sell if you are thinking of moving on. Additionally, buying a single family under $500,000 in many Portland neighborhoods is becoming nearly impossible but is very approachable when considering attached or condo style homes, making them a solid investment and home for someone who values location and condition over lot, size, and independent walls.

Big takeaways

It’s not getting cheaper for buyers here in Portland and our housing stock is limited. We need to build more—likely increasing density and building upward—if we want to decrease the housing shortage. Rock bottom interest rates are probably a thing of the recent past but they are not so high yet that it should prevent buyers from purchasing a home. Sellers: it is still a great time to sell to unlock all the equity in your home by selling but be sure to price aggressively rather than overshoot the market—a hot market does not mean buyers will pay anything if they don’t perceive that your home deserves it. Overall, 2022 looks to be another busy year in real estate!

If you have questions about what is to come, please reach out; I am always happy to help!